A Follow on Public Offering Is Known as Which Issue

A follow-on public offer FPO is an issue of shares by a public company registered and reporting to the Securities and Exchange Commission SEC that is currently listed on an exchange and has previously gone through the IPO process. Pre-Requisites of an FPO.

How Do Stocks Work Money Management Advice Finance Investing Money Strategy

What are the Types of Issues.

/GettyImages-1300495462-e66753342f304f45a9215505352b596a.jpg)

. 1 Public Offering A public offering known as Initial Public Offer IPO involves a company inviting the general public to subscribe or purchase its shares. The share price of a follow-on offering is usually set at a small discount to the current market price of the. A A corporation can have only one primary offeringthe initial public offering IPO.

B There is no limit to the number of primary offerings a corporation can issue. Then its shares are traded on the secondary market. A follow-on public offering FPO is the issuance of shares for investors by a company listed on a stock exchange.

C A corporation can have two primary offeringsthe initial public offering IPO and an additional public offering APO. A follow-on offering involves a secondary sale of shares after a companys initial public offering IPO has been completed. In the case of the dilutive offering the companys board of directors agrees to increase the share float for the purpose of selling more.

Follow on public offer or FPO is a way by which companies already listed on the stock exchange issue shares to the public. A follow-on offering also known as a follow-on public offering FPO is a type of public offering of stock that occurs subsequent to the companys initial public offering IPO. An IPO is an important step in the growth of a business.

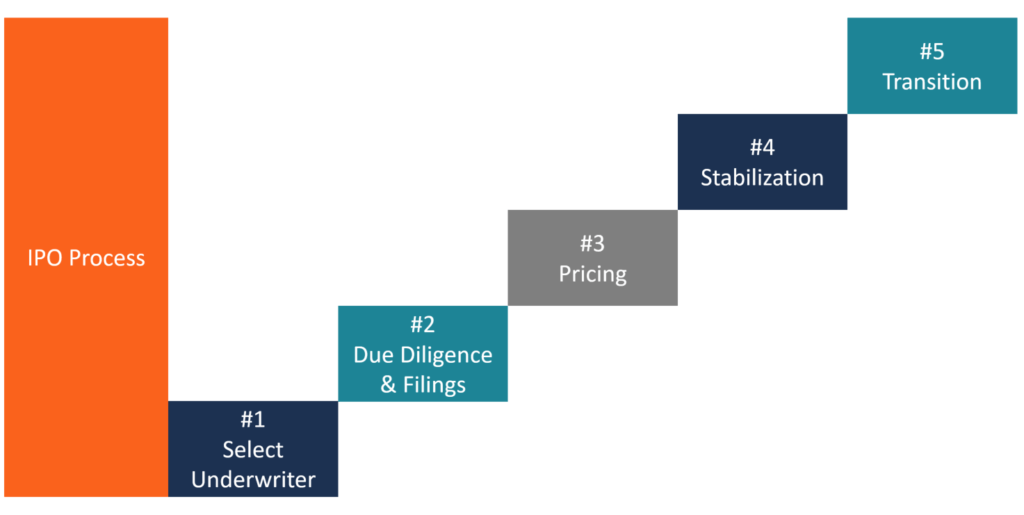

An IPO is typically underwritten by one or more investment banks who also arrange for the shares to be listed on one or more stock exchangesThrough this process colloquially known as floating or going. The process a company follows to offers its shares for sale is known as an Initial Public Offering also known as an IPO. An initial public offering IPO or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail individual investors.

Learn what an IPO is. When an issue offer of securities is made to new investors for becoming part of shareholders family of the issuer it is called a public issue. Public issue can be further classified into Initial Public Offer IPO and Follow on Public Offer FPO.

It is different from an IPO which is when a company offers its shares to the public for the first time. As a result they become a publicly listed company. The issue also includes a reservation of up to 10000 equity shares for.

There are certain prerequisites for the new offering to be categorized as a follow-on public offering. A corporate may raise capital in the primary market by way of an initial public offer rights issue or private placement. It is the largest source of funds with long or indefinite maturity for the company.

A secondary offering is when a company that has already made an initial public offering IPO issues a new set of corporate shares to the public. Initial public offering IPOs is referred to as offering the stock of the company on a public stock exchange for the first time ie all the new shares that are first traded on the primary market are referred to as initial public offering and then they are further traded on the secondary market. The different types of Public Issues are Initial Public Offer IPO Follow on Public Offer FPO and Offer Sale.

This additional offering must be registered with the Securities and Exchange Commission which includes the issuance of a prospectus. FPO is when an already listed company makes either a fresh issue of securities to the public or an o. A follow-on public offer FPO is an issuance.

An Initial Public Offer IPO is the selling of securities to the public in the primary market. A new issue initial public offering IPO at the public offering price. The issue will close on March 28.

There are two ways in which a company can conduct its follow on public offer. In other words a private company wants to be listed on the major stock exchanges. Whenever an Issue or Offer of Securities is made to the New Investors for becoming a part of Issuers Shareholders Family it is known as a Public Issue.

An Initial Public Offering IPO is the first sale of stocks issued by a company to the public. A follow-on offering can categorised as dilutive or non-dilutive. A follow-on offering is an issuance of additional shares made by a company after an initial public offering.

It is the sale of equity shares or other financial instruments to the general public in order to raise capital. It may purchase new equity issues at the public offering price. There is no such condition that the owner has to retain their shares for at least 3 years in order.

Follow-on Public Offering FPO also known as a seasoned equity offering is the method to raise capital by offering additional equity or preference shares after raising funds through an initial public offer. IPO stands for Initial Public Offering and FPO stands for follow-on public offering. It provides a company.

An investment club that has restricted. Will launch its follow-on public offer on March 24. Prior to an IPO a company is considered a private company usually with a small number of investors founders friends family and business investors such as venture capitalists or angel investors.

An FPO is the issuance of additional shares made after an initial public offering. IPO is comparatively more risker than FPO. Also known as the stock exchanges.

Commonly known as the Securities and Exchange Commissions disclaimer the SEC mandates that it be found in the final prospectus. Piedmont has granted the underwriters a 30-day option to purchase up to an additional 262500 shares at the issue price of the Public Offering. A follow-on public offer FPO is an issue of shares by a public company registered and reporting to the Securities and Exchange.

What is Follow on public offering FPO. The FPO comprises equity shares of face value of Rs 2 each aggregating to Rs 4300 crore. The Public Offering is expected to close on March 24.

IPO is the first issue of shares by a company whereas FPO is the issuance of shares by a company to raise additional capital after IPO.

10 Upcoming Ipo S Investing For Beginners Investing Finance Investing Money Saving Strategies

Ipo Adalah Pengertian Cara Kerja Dan Kelebihanya

The Stock Market Archives Napkin Finance Finance Investing Financial Literacy Lessons Economics Lessons

Financial Market Participants Financial Markets Finances Money Financial

/GettyImages-1300495462-e66753342f304f45a9215505352b596a.jpg)

Follow On Offering Fpo Definition

/GettyImages-1220909109-917114c3d73d484da4dba1b81c4a8c66.jpg)

Initial Public Offering Ipo Definition

Publicly Traded Companies Definition And Examples The Motley Fool

Free Ipo Vector Illustration Vectormine Investing Initial Public Offering Raising Capital

Ipo Initial Public Offering How Companies Are Valued And Listed

/shake-shack-471520039-2829280c7c6f4b01bd53440ed49c6368.jpg)

Follow On Public Offer Fpo Definition

Ready For Ipo In April Cashlez Is Targeting To Get Idr 107 4 Billion Initial Public Offering Fintech Startups Technology Solutions

Ipo Initial Public Offering Acronym Business Concept Background Sponsored Sponsored Continuing Education Business Stock Photos Initial Public Offering

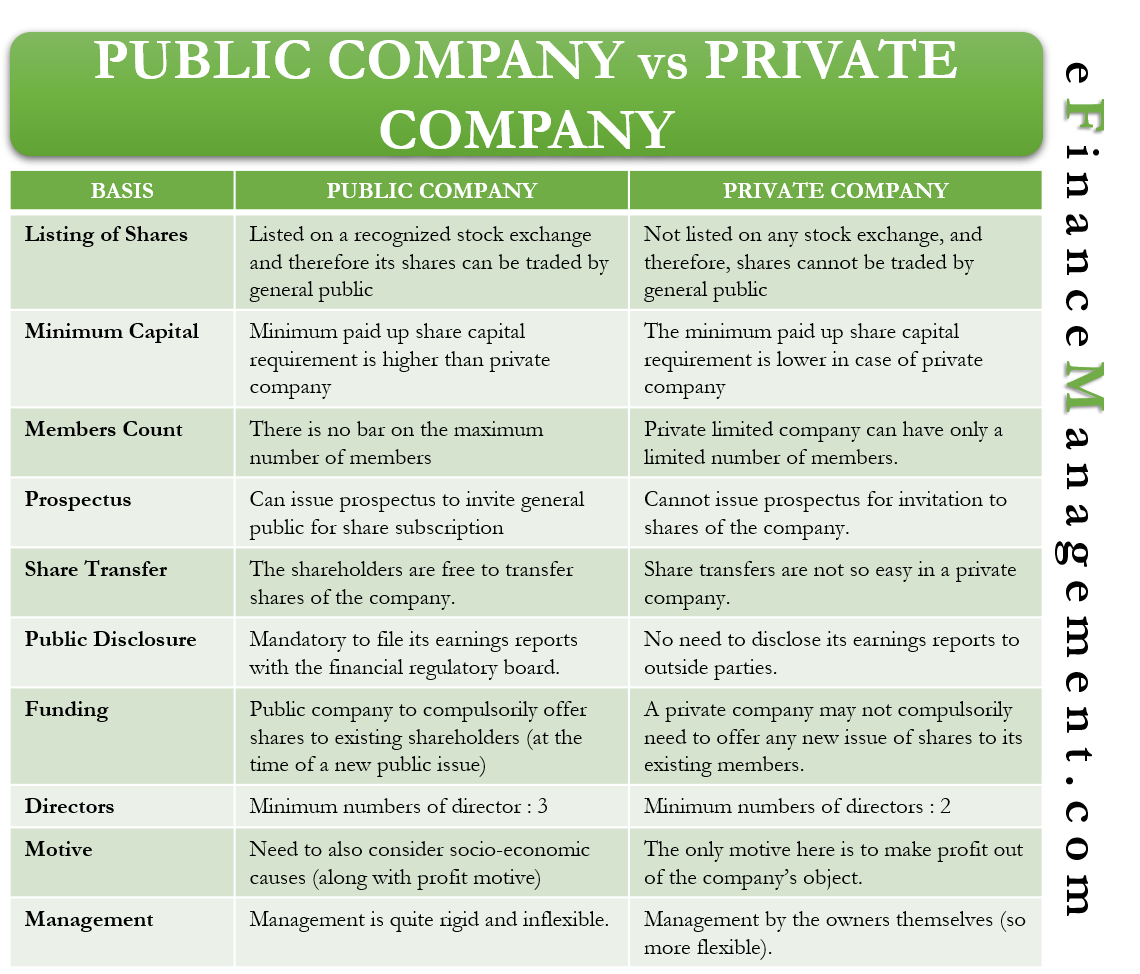

Public Vs Private Company What Is It Differences Conversion Efm

Ipo Process A Guide To The Steps In Initial Public Offerings Ipos

Klikdaily Marks An Initial Public Offering In The Next Three Years Initial Public Offering Empowerment Program Marketing Trends

Comments

Post a Comment